North American consumers in a post COVID-19 world

North American consumers in a post COVID-19 world

Through a series of articles, we, at Novozymes,

aim to review secondary data and provide a

perspective on how a post COVID-19 world

may look for consumers and evaluate its

impact in laundry and home care segment.

COVID-19 has changed the way that we spend as we deal with the economic and health care conditions. As we emerge from this pandemic, there will be a semi-permanent shift towards what we prioritize our economic spending power.

So what will these shifts be?

End of the experiential economy?

Bloomberg recently released an opinion piece that Millennials, the largest demographic by spending power, will shift away from consumer culture of dining, travel and events to a consumption pattern that resembles the purchasing habits of their parents and grandparents.

In the next few weeks, we will see the US open up in phases, however, social distancing will undoubtedly create a lot of headwinds for the experiential economy that we were so used to.

So with a future of full restaurant venues, full flights, or even an Airbnb staycation looking like a distant memory, where will consumers spend their money?

Airbnb, yesterday, laid off 25% of their workforce, with their CEO Brian Chesky citing two hard truths—"we don’t know when travel will return” and “when travel does return, it will look different”-- in his public letter to stakeholders.

Meanwhile, the experiential economy giant, Disney, is prioritizing health and safety measures over its magical experiences, in a bid to get visitors back to its Shanghai Disneyland. This comes at a time when it suffered a loss of USD 1.0 Billion in operating income from parks.

At-home-living is going to be purchase driver

As we get accustomed to the new norm of shelter-in-place, zoom meet-ups, home deliveries, cooking and tele-working, our homes are becoming a sense of inspiration and comfort for us.

This is evident in the recent March retail report by US Census Bureau where we saw a 6.9% Y-o-Y increase in sales for retailers like Home Depot, and Lowes while the clothing retail saw a 50.5% decline, in comparison to previous year. This is not due to coincidence as Washington Post reported that consumers are looking to enhance their at-home living experiences by closing often deferred home projects.

So what does this mean for laundry and home care segments?

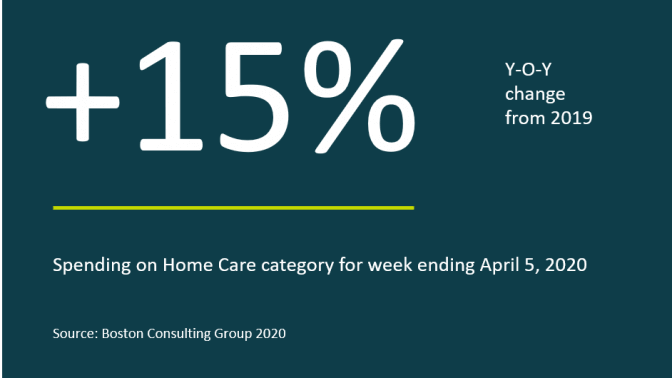

As consumers continue to shift their experiences inside, we will see a continued spend in laundry and home care segments. The main drivers for spend will be efficacy, safety and convenience on products like laundry detergents, disinfectants, and sanitizers.

Manufacturers that are able to address aforementioned drivers meanwhile keeping at-home experience in mind, are likely to see a long-term boost in consumer loyalty.

Novozymes believes that this is an opportunity for us to rethink consumer products to meet the needs of a post-COVID-19 world. Historical approaches are not enough anymore in a disrupted world and we need to adapt quickly.

However, through constant data monitoring and assessment of its impact in North America, Novozymes will aim to provide you with a perspective and help make sense of our new reality in laundry and home care segments.

We hope to join you on our journey to rethink tomorrow.

How can we help?

How can we help?

Reach out to us to discuss how your laundry and home

care brands can adapt to changing retailer needs.